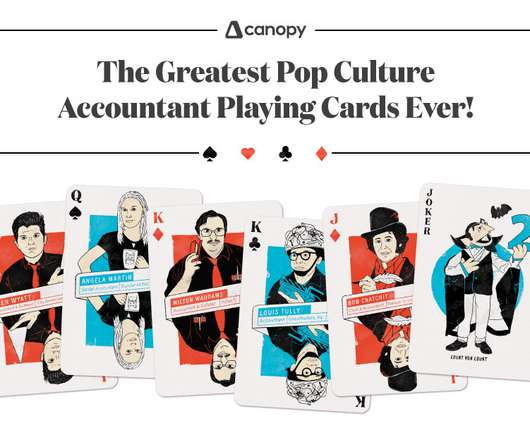

Your Favorite Accountants in Pop Culture | Canopy

Canopy Accounting

JULY 27, 2022

Have you ever wondered how the rest of the world views your job? Entertainment can sometimes give us a peek through that window. Usually, when we want to plug into TV or movies, it’s to escape our daily lives. But, sometimes, it can be fun to watch shows about our lives, especially our work lives! There’s shows about doctors, lawyers, IT teams, journalists, government officials and a myriad of other professions.

Let's personalize your content