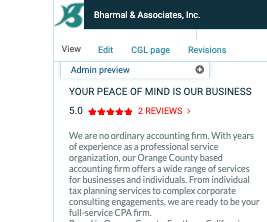

Bharmal & Associates, Inc. Receives First Reviews on Clutch, Maintains Perfect 5.0-Star Average on the Platform

Bharmal&Associates

SEPTEMBER 4, 2020

When you’re looking to hire your next B2B service provider, Clutch.co In a recent review, the CFO and owner of A1 Healthcare, Binita Trivedi, praised the accounting work that we did for their management company. We provided CPA services to a Medicare-certified company that consists of two entities. They’re family-based.

Let's personalize your content