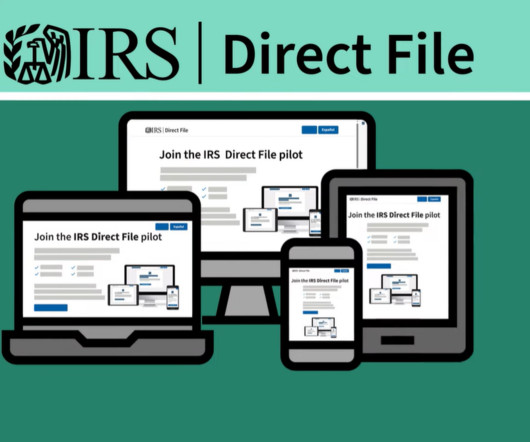

IRS to Try Out Its Free E-Filing Tax Return Program in 13 States Next Year

CPA Practice

OCTOBER 17, 2023

According to the IRS, Arizona, California, Massachusetts, and New York have decided to work with the agency to integrate their state taxes into the Direct File pilot program for the 2024 filing season. In addition, the state of Washington agreed to join the integration effort for its application of the Working Families Tax Credit.

Let's personalize your content