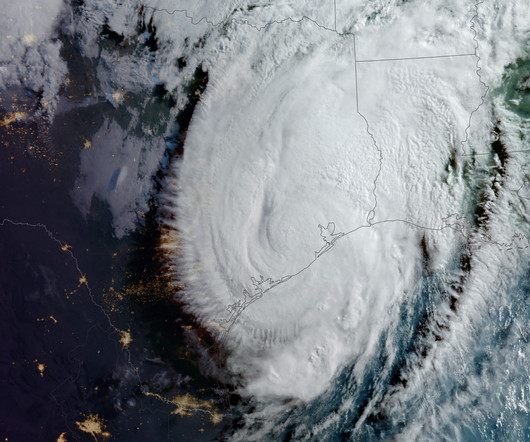

Mississippi, Texas storm victims get tax relief

Accounting Today

JUNE 20, 2025

EDT 3 Min Read Facebook Twitter LinkedIn Email Brad Vest/Photographer: Brad Vest/Getty Im Individuals and businesses in parts of Mississippi and Texas who were affected by severe weather that began in March now have until Nov. 3 to file various federal individual and business returns and make tax payments. All rights reserved.

Let's personalize your content