Improper payment rate still too high at IRS

Accounting Today

MAY 12, 2025

The Internal Revenue Service has not yet satisfied the goal of the Payment Integrity Information Act to reduce improper payment rates to less than 10%.

Accounting Today

MAY 12, 2025

The Internal Revenue Service has not yet satisfied the goal of the Payment Integrity Information Act to reduce improper payment rates to less than 10%.

CPA Practice

MAY 12, 2025

The top 15 accounting firm said it's one of the few firms in the profession to deploy ChatGPT Enterprise across all personnel, unlocking innovation and accelerating client outcomes.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Going Concern

MAY 12, 2025

We were first tipped to layoffs unfolding at RSM US on Friday but weren’t able to confirm until this morning when we received corroboration from another tipster. RSM is making cuts in tax, how many is unknown at this time. Tax leader Tony Urban informed his people today, more info is forthcoming as soon as we have it. We don’t know at this time if other service lines are affected.

Patriot Software

MAY 12, 2025

Ten out of 10 businesses sell products or services. And when you make a sale, you need to record the transaction in your accounting books. How comfortable are you with making a journal entry for sales? How you record the transaction depends on whether your customer pays with cash or uses credit.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

Withum

MAY 12, 2025

On May 10, 2025, New York Governor Hochul signed the 2025-2026 budget bill into law. While there are no major tax changes in the budget bill, several items are worthy of note for taxpayers. Including a payroll tax hike and new rules related to partnership audits. Below is a summary of some of the more important tax changes. We will provide a more detailed analysis of these provisions in the coming days.

Accounting Today

MAY 13, 2025

A report by the Association of Chartered Certified Accountants found 54% of North American respondents say they have career ambitions to be entrepreneurs.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Going Concern

MAY 12, 2025

Here we are, back for another week. Yippee. Comments are off on the Monday news brief by default but you are welcome to hit us up via email or text if you have something to say. Now, here’s some stuff that’s going on. In Milwaukee, a Catholic charity is suing a former employee as well as Baker Tilly , the latter because they didn’t notice almost $2 was missing: Catholic Charities of the Archdiocese of Milwaukee is suing its former finance director, alleging she funneled hundred

Patriot Software

MAY 12, 2025

There might come a time when you dont have enough money to pay your employees. Cash flow might be slow, or a three-paycheck month may surprise you. To help your business make ends meet, you might consider taking out a payroll loan. A payroll loan can be a lifeline.

Canopy Accounting

MAY 12, 2025

Collecting hundredsif not thousandsof client documents, saving them as recognizable names, and storing them in the right place is tedious and time consuming. After all, Every file needs to be in order, and all client information must be protected. However, protecting client information and documents (not by email, for example), sharing them with only the right staff members, and maintaining compliance is challenging to say the least.

Accounting Today

MAY 12, 2025

Approximately three-quarters of large global companies are receiving assurance services on their sustainability reporting, according to a new report.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

CPA Practice

MAY 12, 2025

Proper financial reporting is essential for not-for-profit organizations to maintain transparency, donor confidence, and regulatory compliance. But despite their best intentions, many NFPs consistently make critical errors in their financial statements.

Accounting Insight

MAY 12, 2025

Have you ever been in that situation when you just wanted to ask your accountant that quick question and get an instant answer? This is becoming a reality with the advancement of accounting technology and AI. Often I was waiting for that management report or responding to that one question from two months ago that I needed to find which report had the history.

Patriot Software

MAY 12, 2025

Your businesss financial statements give you a snapshot of the financial health of your company. Without them, you wouldnt be able to monitor your revenue, project your future finances, or keep your business on track for success. So which financial statement is prepared first? Which financial statement is prepared first?

Canopy Accounting

MAY 12, 2025

Collecting hundredsif not thousandsof client documents, saving them as recognizable names, and storing them in the right place is tedious and time consuming. After all, Every file needs to be in order, and all client information must be protected. However, protecting client information and documents (not by email, for example), sharing them with only the right staff members, and maintaining compliance is challenging to say the least.

Speaker: Mark Gilham, FCCA, CPP

Finance used to be the function that counted, now it's the one that’s counted on. 📊 For accounting firms, controllers, and finance leaders, expectations are rising faster than headcount. Businesses want agile forecasts, granular analysis, seamless reporting, and smart automation—often without added resources while demanding uncompromised accuracy and compliance.

Accounting Today

MAY 12, 2025

The investment strategy may generate much greater loss harvesting than direct indexing, but backers point out that they work much differently.

CPA Practice

MAY 12, 2025

U.S. regulatory compliance professionals cited keeping abreast of regulatory changes (43%), assessing risk profiles across multiple asset classes (42%) and accurately identifying insider trading and market manipulation (40%) as their top three choices.

Accounting Insight

MAY 12, 2025

Artificial intelligence (AI) technology represents a turning point for many industries, including the accounting industry, as we see a shift in the way accountants are working as a result. In this report, we surveyed 100 accountants to discover how theyre using AI, what type of AI theyre using, their opinion on AI technology, their trust in it, and what they think the future will look like.

Insightful Accountant

MAY 12, 2025

Each year, Insightful Accountant honors the most dedicated, innovative, and impactful professionals in accounting through our Top 100 ProAdvisor Awards Program. And this year, were bringing that celebration to life in an unforgettable way.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Canopy Accounting

MAY 12, 2025

When accountants look at practice management software, pricing is often one of the first questionsand one of the hardest to compare across platforms.

Accounting Today

MAY 12, 2025

The Financial Accounting Standards Board released an update to improve the requirements for identifying the accounting acquirer in business combinations.

CPA Practice

MAY 12, 2025

More than 2 in 5 (43%) U.S. adults say money negatively affects their mental health, at least occasionally, causing anxiety, stress, worrisome thoughts, loss of sleep, depression and other effects, according to Bankrate.

Ace Cloud Hosting

MAY 12, 2025

The accounting industry has long been known for its relentless work ethic. With the evolution of the global business landscape, companies now dont look at accountants as just number crunchers.

Speaker: Frank Taliano

Documents are the backbone of enterprise operations, but they are also a common source of inefficiency. From buried insights to manual handoffs, document-based workflows can quietly stall decision-making and drain resources. For large, complex organizations, legacy systems and siloed processes create friction that AI is uniquely positioned to resolve.

Insightful Accountant

MAY 12, 2025

The tax profession faces unprecedented recruiting challenges in 2025. As specialized tax expertise becomes increasingly valuable amid evolving legislation, firms struggle with a diminishing pipeline of qualified candidates.

Accounting for Good

MAY 15, 2025

When an organisation, including an NFP, purchases an asset, why is it capitalised rather than recorded as an expense?

Accounting Today

MAY 12, 2025

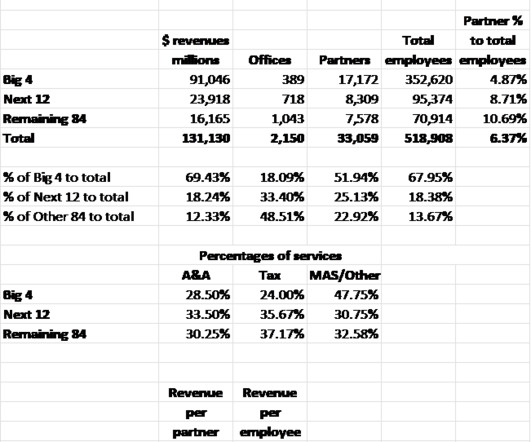

Public accounting is a vibrant and strong profession and also a business, as shown in data from the latest rankings on firm revenues, partners and staff size.

CPA Practice

MAY 12, 2025

A new report from the AICPA & CIMA and the International Federation of Accountants found that nearly three in four of the largest companies sought assurance on some aspect of their sustainability disclosures.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

Ryan Lazanis

MAY 14, 2025

Predictability is key if you want to systematize your firm. Here are a few practical tips I used back when I was running mine. The post The Critical Feature of a Systematized Firm: Predictability appeared first on Future Firm.

Insightful Accountant

MAY 14, 2025

A recent Treasury Inspector General for Tax Administration report reveals that IRS "sweeps" targeting high-income nonfilers have proven remarkably effective.

IgniteSpot

MAY 14, 2025

Discover how accounting firms are addressing the talent gap by investing in team development, mentorship, and education partnerships to prepare future leaders.

Accounting Today

MAY 13, 2025

The Chartered Institute of Management Accountants updated its CGMA Professional Qualifications Syllabus for 2026 to emphasize finance business partnering and applied problem solving.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Let's personalize your content