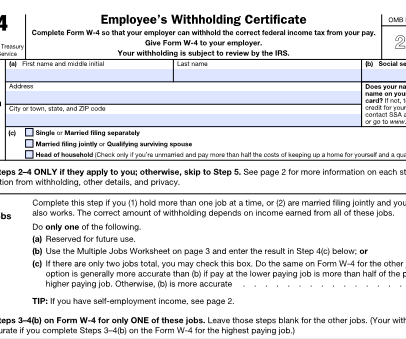

IRS Makes Minor Changes to 2023 W-4 Form

CPA Practice

FEBRUARY 15, 2023

Unlike the big W-4 form shakeup of 2020, there aren’t significant changes to the new form. You may not file Form W-4 with the IRS, but your payroll depends on it. Employers use Form W-4 to determine how much to withhold from an employee’s gross wages for federal income tax. Don’t get caught out of the loop.

Let's personalize your content