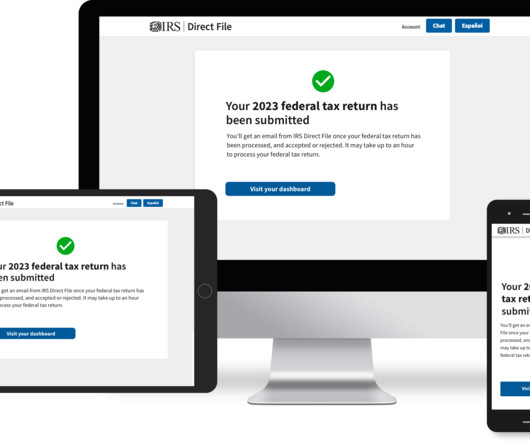

Should I File My 2020 Tax Return Early?

RogerRossmeisl

FEBRUARY 13, 2021

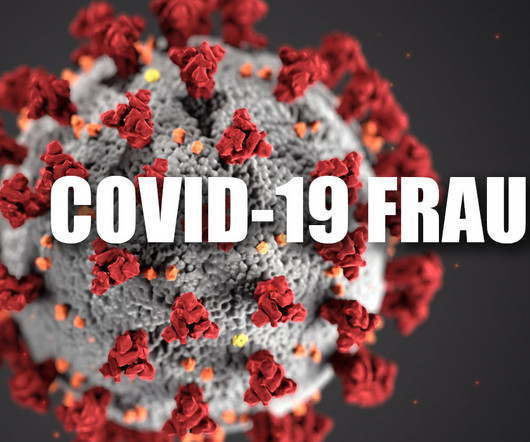

The IRS opened the 2020 individual income tax return filing season on February 12. You can potentially protect yourself from tax identity theft — and there may be other benefits, too. The real taxpayer discovers the fraud when he or she files a return and. The post Should I File My 2020 Tax Return Early?

Let's personalize your content