In ongoing accounting crunch, where to go for sales tax help?

TaxConnex

FEBRUARY 27, 2024

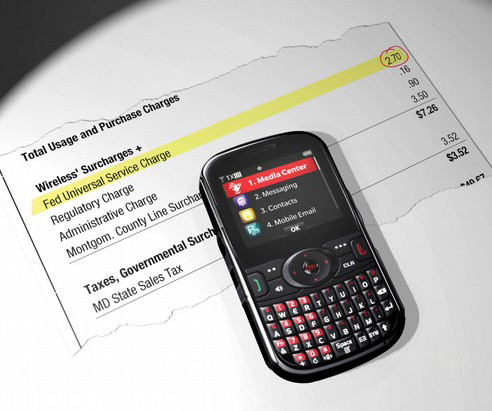

Your sales tax obligations depend on knowledge and that knowledge often resides in a professional tax specialist (usually an accountant) who helps your company meet its sales tax obligations. This is a complicated time for sales tax obligations – and a terrible time to try to hire an accountant.

Let's personalize your content