Los Angeles Tax Services – Local tax firm serving all Southern California

MyIRSRelief

OCTOBER 3, 2022

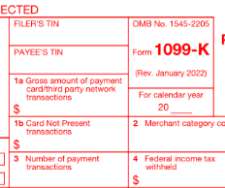

There is a substantial amount of time you have to file your taxes, but the process can seem hefty. With the help of Los Angeles tax services firms, you can receive information on your tax return, the amount you owe, and various resources for tax preparation service. The Los Angeles County sales tax rate is 0.25%.

Let's personalize your content