Feds Cracking Down on Unlawful Tax Return Preparers

CPA Practice

APRIL 11, 2024

Unscrupulous preparers who include errors or false information on a tax return could leave a taxpayer open to liability for unpaid taxes, penalties and interest. Taxpayers must look out for unscrupulous preparers, who often will promise refunds that are too good to be true,” said Deputy Assistant Attorney General David A.

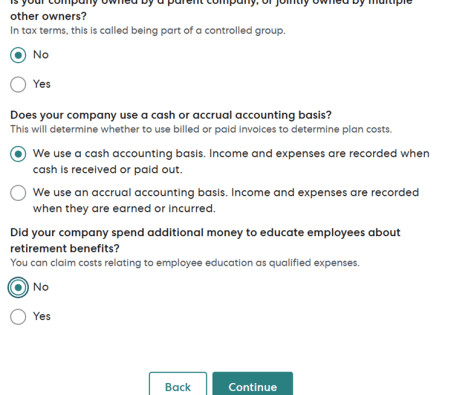

Let's personalize your content