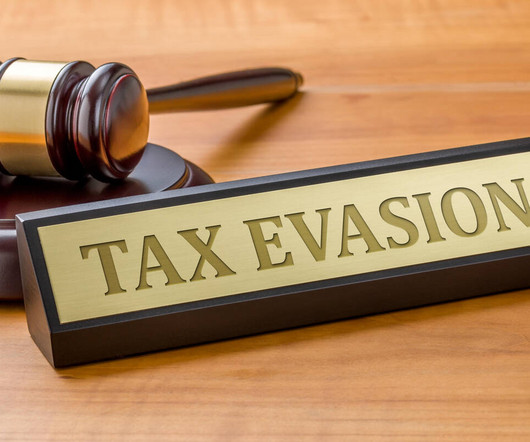

Accountant Pleads Guilty to Filing False Tax Returns in Connecticut

CPA Practice

AUGUST 30, 2024

29—FARMINGTON — An accountant pleaded guilty in Bridgeport Thursday to filing fraudulent tax returns for multiple years after failing to report $1.4 million in income, federal officials said. Legowski prepared tax returns for between 400 and 500 individual clients, 50-60 businesses, the U.S.

Let's personalize your content