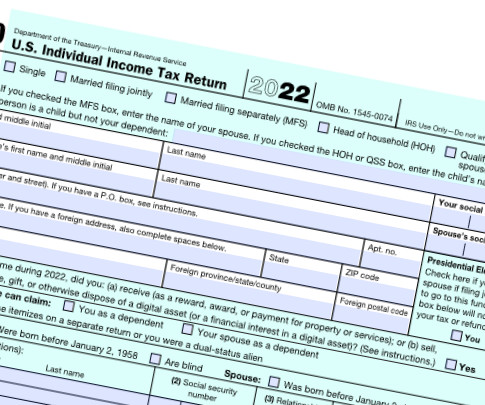

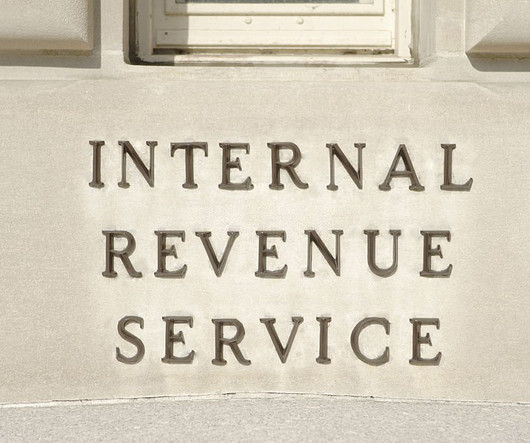

Form 1120: U.S. Corporation Income Tax Return

Canopy Accounting

SEPTEMBER 29, 2023

Corporation Income Tax Return, plays a crucial role in the world of taxation for corporations. As an accountant, it is essential to have a firm grasp of this form and its implications. In this blogpost, we will explore the key aspects of Form 1120 and its significance in filing corporate taxes. Form 1120, the U.S.

Let's personalize your content