The Best Tech for Accounting Firms: CPAs Voted for Readers Choice Tech Awards

CPA Practice

MAY 15, 2024

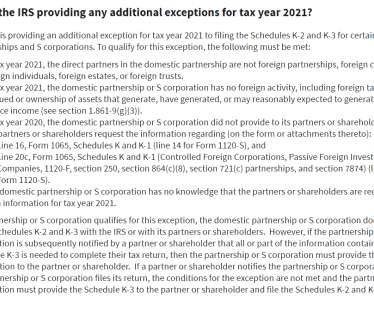

The technologies used in professional accounting firms continue to evolve and shape how practices function, from client service, to staffing issues, and overall management and growth. Of course, nobody can know everything, so it’s important to have access to comprehensive tax research tools. Now, on to the results!

Let's personalize your content