The Parallel Problems of Public Accounting & Major League Baseball

CPA Practice

JANUARY 18, 2023

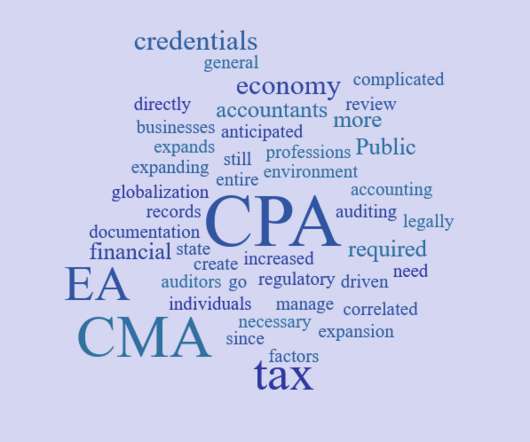

After reading former MLB manager Joe Maddon’s recent book, The Book of Joe – cowritten with Tom Verducci –it struck me: The plight of the public accounting industry is not unlike that of Major League Baseball. Let’s look at some of the parallel problems facing both public accounting and MLB. Advanced technology.

Let's personalize your content