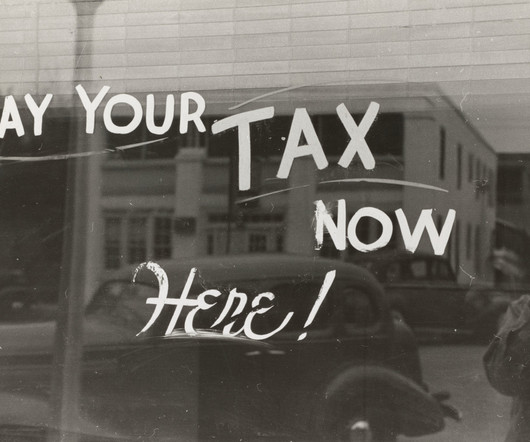

Tax Obligations Every Canadian Small Business Should Know

Ronika Khanna CPA,CA

JUNE 7, 2024

If you are registered in Quebec, you are also required to file QST Returns. Sales tax returns reflect the amounts charged on products and services, which are collected on behalf of the government. Does your small business qualify for the quick method of reporting GST-HST & QST ? Check out my books for small business.

Let's personalize your content