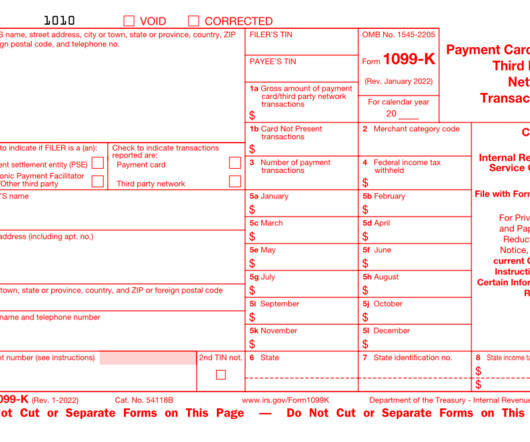

Here’s All of the 1099 Form Types, From A to SB

CPA Practice

APRIL 12, 2023

By Dawn Moser Tax forms are notoriously confusing, and with such high stakes, important to get right. We all know the IRS is keen on collecting the right amount of income tax, but determining that amount can get tricky. Especially when one considers everything that counts as income.

Let's personalize your content