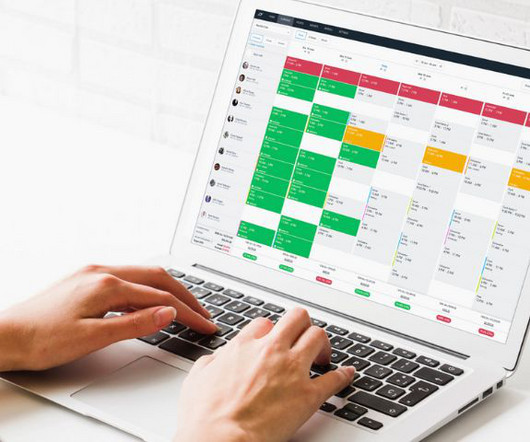

Employee management tools to help your cash flow

Xero

SEPTEMBER 27, 2023

Think: building rosters, managing timesheets, setting wages, processing payroll and communicating to your teams. Manual processes leave room for error which can also affect your balance sheet. If you’re paying staff in line with an award, your employees must be paid in accordance with the award rates and penalties.

Let's personalize your content