Effective Marketing in Minutes: Essential Tips for the Time-Strapped CPA

CPA Practice

JANUARY 18, 2024

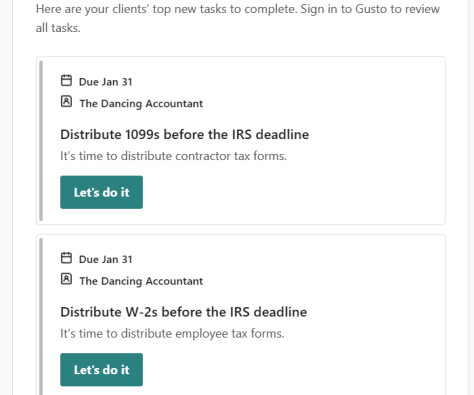

In today’s fast-paced world, you are constantly juggling between client needs, regulatory demands, and staying abreast of ever-changing tax laws. Update your social media bios, especially LinkedIn and Google Business. Helping [your niche] stress less this tax season! Ready to check taxes of your to-do list?

Let's personalize your content