Outsourced Bookkeeping for CPAs: 8 Options Compared

Ryan Lazanis

SEPTEMBER 27, 2023

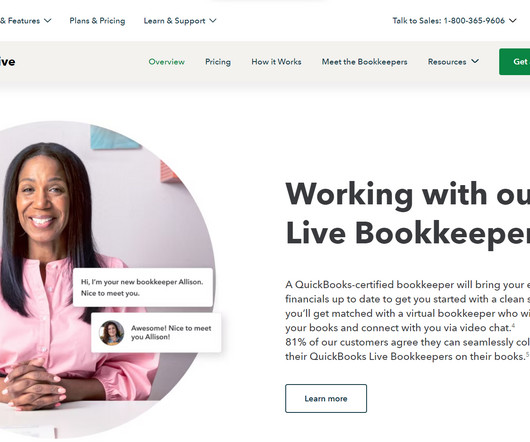

If you’re a CPA firm looking to outsource your bookkeeping, you’ll want to check out this post on the 7 different options for outsourced bookkeeping for CPAs. Besides bookkeeping, they can handle other accounting tasks, with potential tax law training needed.

Let's personalize your content