Los Angeles tax, accounting service

MyIRSRelief

DECEMBER 15, 2022

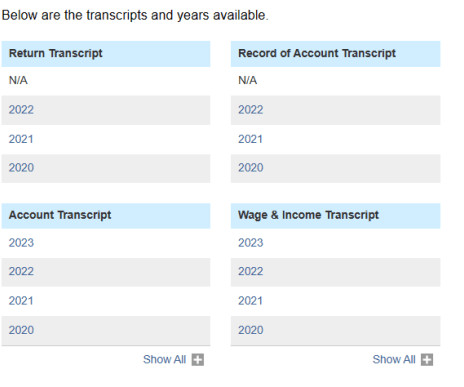

Our Los Angeles based tax firm , led by Mike Habib, Enrolled Agent, represents and helps business taxpayers get compliant with back years, contact us today at 1-877-78-TAXES [1-877-788-2937]. What are the benefits of accounting & bookkeeping services? What is income tax preparation service?

Let's personalize your content