Coronavirus Aid, Relief and Economic Security (CARES) Act

VetCPA

APRIL 1, 2020

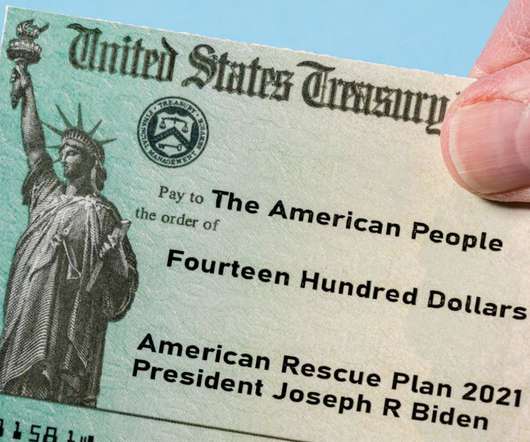

The Coronavirus Aid, Relief and Economic Security Act (CARES Act or Act), which includes cash payments to taxpayers, expanded unemployment insurance, increased funding for healthcare providers, small business loans, and tax relief to businesses. The Act is the third bill from Congress in response to the COVID-19 pandemic.

Let's personalize your content