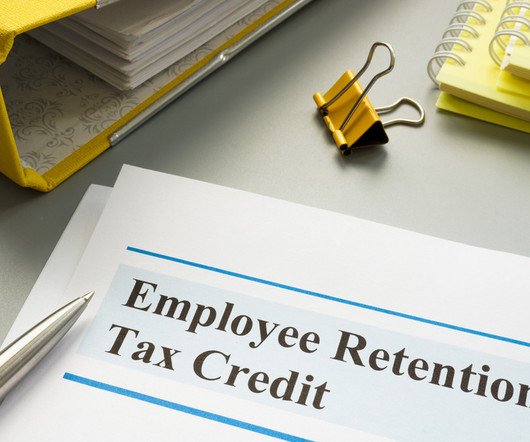

California Main Street Small Business Tax Credit II Begins 11/1/21

RogerRossmeisl

SEPTEMBER 26, 2021

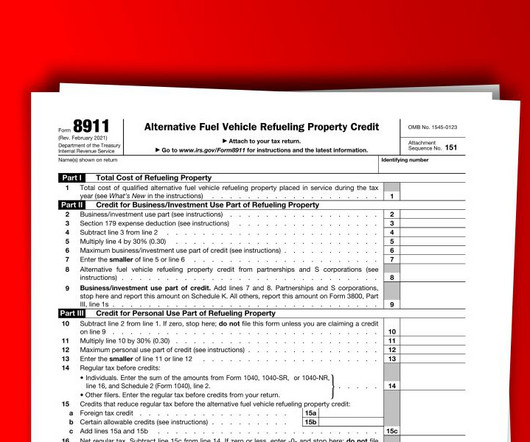

50 (AB-50) established the California Main Street Small Business Tax Credit II, which will provide COVID-19 financial relief to qualified small business employers. Small Business Tax Credit. The post California Main Street Small Business Tax Credit II Begins 11/1/21 appeared first on Roger Rossmeisl, CPA.

Let's personalize your content