How Entrepreneurs Expenses are Claimed on Tax Returns

RogerRossmeisl

JANUARY 26, 2022

Whatever the reason, if you’ve recently started a new business, or you’re contemplating starting one, be aware of the tax implications. As you know, before you even open the doors in a start-up business, you generally have to spend a lot of money. You may have to train workers and pay for rent, utilities, marketing and more.

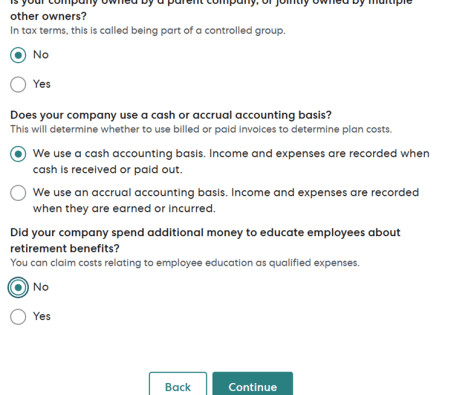

Let's personalize your content