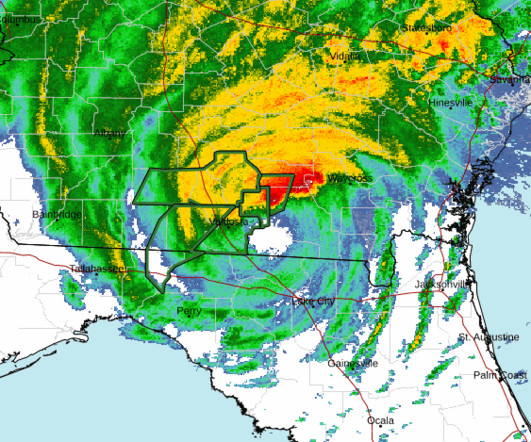

IRS Provides Idalia Tax Relief

Withum

SEPTEMBER 1, 2023

On August 30, 2023, the IRS announced relief from certain tax filing and payment deadlines for individuals and businesses in parts of Florida that were affected by Hurricane Idalia. 46 of Florida’s 67 counties were mentioned in the News Release, but others have been added since then. 15, 2023, and Jan. 31, 2023, and Jan.

Let's personalize your content