Should you register for GST/HST and QST and What it Means to Be Zero Rated

Ronika Khanna CPA,CA

SEPTEMBER 28, 2023

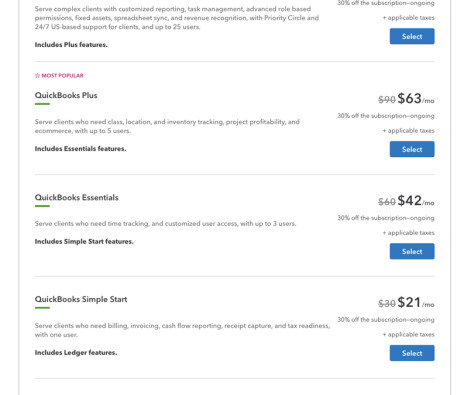

However, keep in mind that you might lose the ability to claim tax paid on expenses which can add up particularly for businesses that have high start up costs, How to Set Up Sales Taxes (GST/HST and QST) In QuickBooks Online: Below is a video tutorial on setting up your sales tax for the first time in QuickBooks Online and how it works in practice (..)

Let's personalize your content