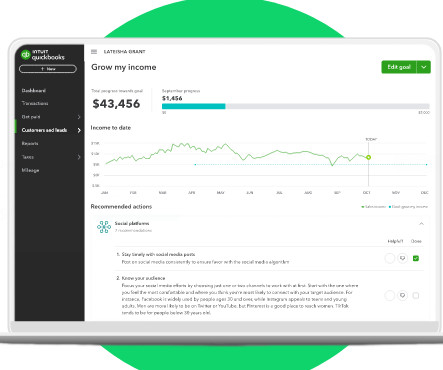

Intuit Introduces QuickBooks Solopreneur for One-Person Clients

CPA Practice

FEBRUARY 27, 2024

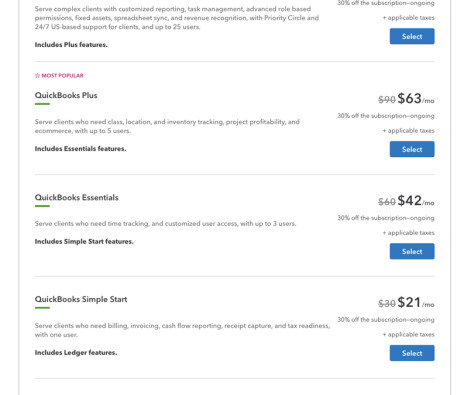

Welcome to QuickBooks Solopreneur. And let’s face it, they could really use your help in getting their finances not only organized, but tax ready as well. And let’s face it, they could really use your help in getting their finances not only organized, but tax ready as well. QuickBooks Solopreneur can help them do that.

Let's personalize your content