How to File T4s using Quickbooks Desktop

Ronika Khanna CPA,CA

FEBRUARY 23, 2024

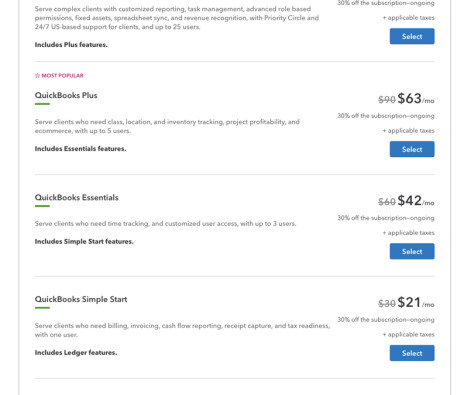

The Canada Revenue Agency (CRA) encourages businesses to file the T4s electronically and it should be noted that e-filing is mandatory for employers with more than 50 employees. Quickbooks automatically generates an efile number and asks for a transmitter number. Planning to transition to QuickBooks Online?

Let's personalize your content