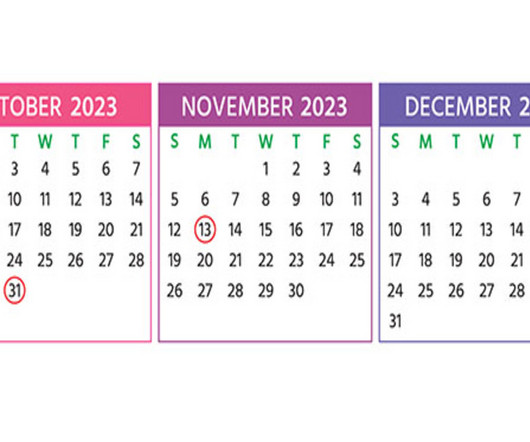

2023 Q4 Tax Calendar: Key Deadlines for Businesses and Other Employers

RogerRossmeisl

NOVEMBER 8, 2023

Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Monday, October 2 The last day you can initially set up a SIMPLE IRA plan, provided you (or any predecessor employer) didn’t previously maintain a SIMPLE IRA plan.

Let's personalize your content