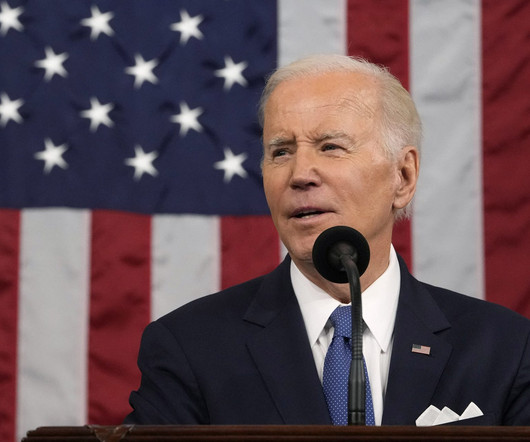

U.S. Corporate Taxes Likely to Rise to Tame Deficit, Buffett Says

CPA Practice

MAY 7, 2024

The Berkshire Hathaway chairman and chief executive officer, speaking Saturday at the company’s closely watched annual meeting in Omaha, sidestepped directly commenting on the partisan fight over corporate taxes taking shape. But he said his company will pay whatever the rate is, whether the current 21% or something higher.

Let's personalize your content