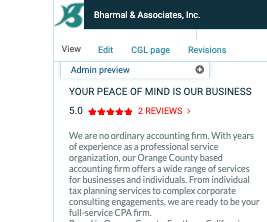

Bharmal & Associates, Inc. Receives First Reviews on Clutch, Maintains Perfect 5.0-Star Average on the Platform

Bharmal&Associates

SEPTEMBER 4, 2020

From individual tax planning services to complex corporate consulting engagements, we are ready to be your full-service CPA firm. Clutch’s office is a few steps away from the Washington Monument in the District of Columbia. We provided CPA services to a Medicare-certified company that consists of two entities.

Let's personalize your content