Quality management standards: Time is running out!

Accounting Today

FEBRUARY 10, 2025

For auditors and quality management, there's a big difference between a 'document' and a 'system.

Accounting Today

FEBRUARY 10, 2025

For auditors and quality management, there's a big difference between a 'document' and a 'system.

Xero

FEBRUARY 10, 2025

We’re kicking off the new year with some exciting Xero updates designed to address some of the enhancements youve been asking for, and make things more automated to save you time. Keep reading to learn how these enhancements will benefit you and your business. Global: Enhancements to new invoicing [Product Idea ] You’ll love the time-saving enhancements we have made to new invoicing this month.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Going Concern

FEBRUARY 10, 2025

Um, what is this? The CPA Exam remains broken. Q4 2024 Pass Rates: Core: FAR – 36.80% AUD – 43.50% REG – 60.40% Discipline (Candidates Choose 1): BAR – 33.70% TCP – 72.20% ISC – 56.40% A few thoughts: The consensus on the new exam was FAR would see higher pass rates as difficult material — Dr. Josh McGowan, CPA (@Jmcgowan3838) February 8, 2025 Full text of Dr.

Shay CPA

FEBRUARY 10, 2025

For early-stage startups, research and development (R&D) is the lifeblood of innovation. Historically, small companies benefited from being able to immediately deduct R&D costs each year. However, legislative changes enacted under the Tax Cuts and Jobs Act (TCJA) of 2017 have altered the playing field. This post explores Section 174 in its current form, common pitfalls for founders, and practical strategies to help you navigate these rules effectivelyeven as legislative uncertainty looms

Advertisement

The office of the CFO is rapidly evolving, with more and more demands being placed upon the finance and accounting team each year. Join us in this webinar, where we share 8 things to NOT do when it comes to helping the CFO office advance in supporting the business. Learning Objectives: This course objective is to understand how best to support an organization's finance leadership.

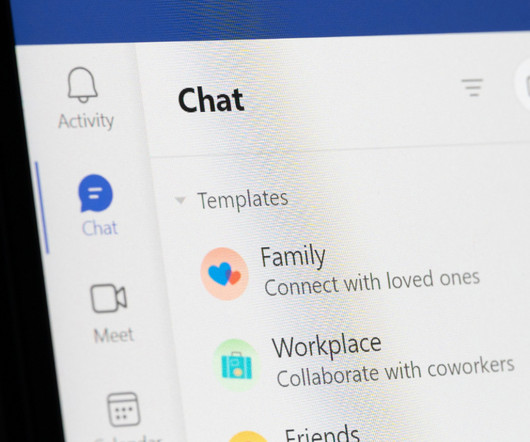

Withum

FEBRUARY 10, 2025

Information overload is a challenge for everyone. Im always excited to check out features that will make my life easier and keep things organized. Microsoft Teams channels have long been a critical way to stay productive, and now Microsoft Teams has made one of the biggest changes to the Teams chat UI in recent memory: a combined layout for both channels and chats.

Basis 365

FEBRUARY 10, 2025

Keeping your business successful requires well-managed financial records, but taking the time and money to build an accounting team can use up resources you cant spare. If youre finding it difficult to keep up with your bookkeeping but dont want to hire an in-person accounting team, its time to consider alternative solutions! Outsourcing your accounting needs can scale with your business while ensuring accuracy, and its quickly becoming a standard for successful businesses.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Withum

FEBRUARY 10, 2025

Starting January 2025, due to Pennsylvania Act 122, most domestic and foreign filing associations registered to do business in Pennsylvania are required to file an Annual Report. This report will replace the prior filing, which is required once every 10 years, to confirm the existence of entities that have not made some other type of filing with the Pennsylvania Corporation Bureau during the preceding 10 years.

Going Concern

FEBRUARY 10, 2025

Good morning, counterati. It’s Monday again, here is some news for you to start your week. ‘Tis the season to get tax advice from TikTok. p.s. It’s they’re , buddy. Accountants are too stupid to know about this because after all the schooling they just STOP learning! pic.twitter.com/BuMGHJuKx9 — Jessica Smith, EA , not a CPA (@Taxsavvyjessica) February 9, 2025 Something to chew on as both sides argue about fraud and waste: My dad was an auditor with The Indiana Depa

Withum

FEBRUARY 10, 2025

Microsoft Copilot has an update: Microsoft 365 Copilot Chat is now available! Copilot Chat is free access to Enterprise grade Copilot, giving organizations a taste of Copilot. This version has some limitations but is a great starting point for organizations not ready to get the value from the $30/month Copilot license. Key Features of Microsoft 365 Copilot Chat Web-Grounded Chat with GPT-4o: Microsoft 365 Copilot Chat is powered by GPT-4o , providing a robust and secure AI chat experience.

Dent Moses

FEBRUARY 10, 2025

President Donald Trump has proposed a plan to eliminate federal taxes on tips, aiming to increase take-home pay for workers in the hospitality and service industries. This initiative is part of a broader tax reform agenda that includes removing taxes on overtime pay and Social Security benefits. Under current federal law, tips are taxable income, subject to income and payroll taxes.

Speaker: Dylan Secrest, Founder of Alamo Innovation and Construction Digital Transformation Consultant

Construction payment workflows are notoriously complex when you consider juggling multiple stakeholders, compliance requirements, and evolving project scopes. Delays in approvals or misaligned data between budgets, lien waivers, and pay applications can grind progress to a halt. The good news? It doesn't have to be this way! Join expert Dylan Secrest to discover how leading contractors are turning payment chaos into clarity using digital workflows, integrated systems, and automation strategies.

Menzies

FEBRUARY 10, 2025

Menzies LLP - A leading chartered accountancy firm. All firms must understand the circumstances within their business models where breaches of CASS can occur and ensure that they have adequate systems and controls in place to identify non-compliance. Firms retain full responsibility for the compliance of the outsourced operational functions this includes any breaches that may occur by a third party.

CPA Practice

FEBRUARY 10, 2025

This chart can help you estimate when you should get your 2025 income tax return, based on when you file and a few other easy factors.

Withum

FEBRUARY 10, 2025

In a recent move, President Donald Trump has proposed to eliminate the carried interest tax loophole, a tax break that has long benefited Wall Street investment managers. This proposal aligns Trump with many Democratic lawmakers who have also sought to remove long term capital gains from carried interest. What Is Carried Interest? Carried interest refers to the share of profits that investment managers receive from their funds, typically around 20% of the profits.

ThomsonReuters

FEBRUARY 10, 2025

In todays rapidly evolving business landscape, companies of all sizes are upgrading their technological infrastructure to improve productivity and remain competitive. These digital transformations typically involve transitioning to a cloud-based business system, and they are important to corporate tax leaders because the tax function touches virtually every aspect of a modern organization.

Advertisement

You wouldn’t keep using a 2009 flip phone - so why settle for outdated close processes? It’s time for an upgrade. SkyStem's Guide to Month-End Close Software walks you through what today’s best tools can do (and what your team shouldn’t have to deal with anymore). Get smart, fast, and a whole lot less stressed when it’s time to close the books.

Accounting Today

FEBRUARY 10, 2025

AICPA & CIMA president and CEO Mark Koziel told a group of accountants that the association is preparing for the possibility of the PCAOB being "rolled up.

CPA Practice

FEBRUARY 10, 2025

Since the start of the 2025 tax filing season on Jan. 27, the IRS has issued 3.23 million refunds with an average refund amount of $1,928 as of Jan. 31, the agency said last week.

Insightful Accountant

FEBRUARY 10, 2025

All 2025 ProAdvisor Award Applications must be completed no later than this Saturday, February 15, 2025 at 11:59:59 PM Pacific-time.

CPA Practice

FEBRUARY 10, 2025

The FICPA Leadership Academy is a selective, high-impact program for CPAs age 35 and under who are looking to grow as leaders within their firms and the profession.

Speaker: Gerald Ratigan

The accounts payable (AP) function is evolving and AI is leading the charge. As finance teams face rising invoice volumes and expectations for speed and accuracy, AI-powered automation has shifted from a futuristic concept to the most practical solution. But for finance leaders, success isn’t just about selecting the right tools, it’s about implementing the right strategy.

Accounting Today

FEBRUARY 10, 2025

Former AICPA president and CEO Barry Melancon is joining Baker Tilly U.S. as an advisor Baker Tilly International as a non-executive director and chair-elect.

CPA Practice

FEBRUARY 10, 2025

This years inductees include David R. Bean, Barry C. Melancon, Terry Shevlin, and Mary T. Washington Wylie (1906-2005). The 2025 inductees represent a diverse group of accounting thought leaders, from practice and academia.

AccountingDepartment

FEBRUARY 10, 2025

It is that time of the year again, tax season. Many businesses dread this time of the year - it's tough. But thankfully, it's not as tough when you have the unrivaled support of AccountingDepartment.com.

CPA Practice

FEBRUARY 10, 2025

The Columbus, OH-based top 100 firm has acquired Talentcrowd, a referral-based hiring platform also based in Columbus that brings tech talent to top companies and teams, effective Jan. 31.

Speaker: Sean Yoder

Nonprofits are under more pressure than ever to demonstrate financial accountability while continuing to expand their impact. Traditional budgeting models often fall short, reinforcing silos, limiting flexibility, and stalling growth. Enter collaborative budgeting: a dynamic, team-driven process that enables smarter resource allocation and builds financial resilience at scale.

Accounting Today

FEBRUARY 10, 2025

Kim Blascoe of CPA.com dives into CAS's extraordinary growth rates, the key practices of a high-performing CAS practice, and more.

CPA Practice

FEBRUARY 10, 2025

The Louisiana native, who retired at the end of last year after a nearly 30-year run as AICPA chief executive, will join Baker Tilly as an advisor and will become a non-executive director and chair-elect of the Baker Tilly International board of directors.

Insightful Accountant

FEBRUARY 10, 2025

The rise of AI agents is poised to fundamentally reshape how tax firms operate and compete. As autonomous AI systems become more sophisticated, firms must prepare for significant changes.

CPA Practice

FEBRUARY 10, 2025

Elon Musk's DOGE team will be in Parkersburg, WV,from Tuesday through Thursday, whereTreasurykeeps its Central Accounting Reporting System, or CARS, which handles accounting and reporting access for all federal agencies.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Accounting Today

FEBRUARY 10, 2025

The estimate for the amount required for 65-year-old spouses is one of many from a study full of figures that financial advisors can use to highlight the value of HSAs.

CPA Practice

FEBRUARY 10, 2025

The new software offering from Stampli unifies all procurement processes, documents, and discussions into a single workflow.

Accounting Today

FEBRUARY 10, 2025

Accountants should stop focusing on the past data they generated, and the current situations their clients are in, and migrate to a future-oriented spotlight.

CPA Practice

FEBRUARY 10, 2025

Respondents shared their thoughts on the latest trends in employee attitudes, desires and concerns across various sectors, including technology, banking, healthcare, manufacturing, retail and transportation and distribution.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Let's personalize your content