Customizing the Icon Bar in QuickBooks Desktop

Insightful Accountant

APRIL 9, 2023

Check out some of the cool customization features you can use with the icon bar, complements of internationally renowned ProAdvisor Esther Friedberg Karp.

Insightful Accountant

APRIL 9, 2023

Check out some of the cool customization features you can use with the icon bar, complements of internationally renowned ProAdvisor Esther Friedberg Karp.

Nancy McClelland, LLC

APRIL 9, 2023

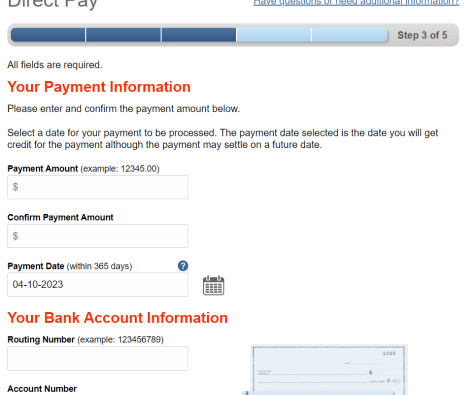

The IRS “Direct Pay” landing page, There are multiple options for paying personal quarterly estimated taxes. You can: have your tax preparer create vouchers that you then print and mail with a check; prepare your own vouchers and do the same; or pay online. Since March 2020, the IRS, USPS, and state revenue agencies have had so many challenges with mailed paper checks and vouchers that we strongly encourage everyone to make all tax payments online.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Insightful Accountant

APRIL 9, 2023

The quarterly 'Paychex | IHS Markit Small Business Employment Watch' shines a spotlight on the ever-changing small business landscape.

Nancy McClelland, LLC

APRIL 9, 2023

Reminder: Due to a new law , Illinois S-Corp and Partnership owners should generally pay quarterly IL state ( not federal) taxes through the business. The post below is about how to pay IL taxes personally ; click here for how to make IL business tax payments. There are multiple options for paying personal quarterly estimated taxes. You can: have your tax preparer create vouchers that you then print and mail with a check; prepare your own vouchers for the IRS and IL DoR ; or pay online.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. But if you’re aiming for the summit, the air gets thinner, and what got you here won’t be enough to get you to the top. 🗻 What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level. The higher you go, the more your effectiveness depends on how you connect, adapt, and communicate.

VJM Global

APRIL 9, 2023

The government keeps on announcing Amnesty schemes so that a one-time facility is provided to taxpayers to become tax complied by paying a reduced amount of late fees and penalties. Amnesty schemes encourage defaulters to become legally compliant as they have to pay a lower amount of penalties. The government has once again issued multiple notifications on 31st March 2023 and came up with amnesty schemes for various GST returns such as GSTR-4 (Return of Composition Dealer), GSTR-10 (Final Return

Let's personalize your content