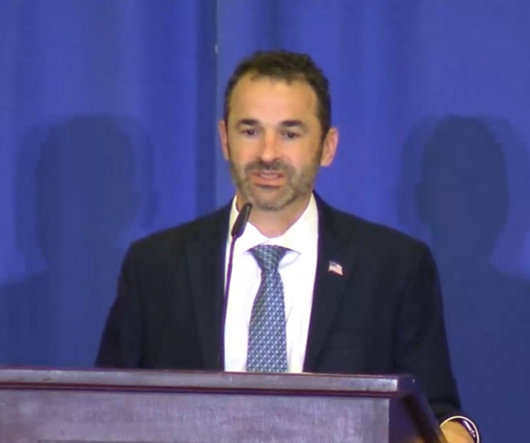

Accountants Among the Happiest Workers in the U.S., New Study Finds

CPA Practice

JULY 22, 2024

New research by international telecommunications provider TollFreeForwarding.com reveals that accounting and tax is the second-happiest industry to work in. The Los Angeles-based company analyzed Glassdoor review data for 200 companies across 10 industries and ranked them based on the following six criteria: Culture and values Diversity and inclusion Work-life balance Compensation Career opportunities Senior management satisfaction Each industry was scored on a scale of 1 to 100 for each categor

Let's personalize your content