10 Tax Preparer Penalties to Avoid | Canopy

Canopy Accounting

FEBRUARY 25, 2024

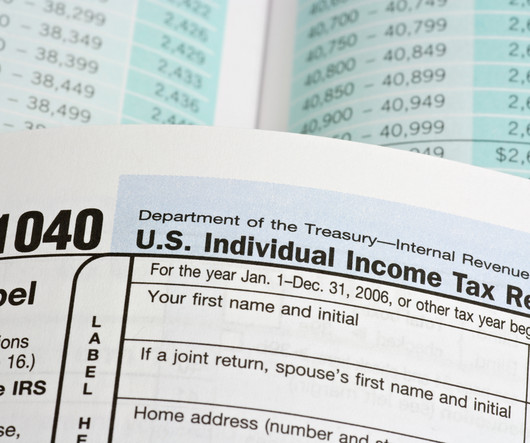

Your clients count on you to handle their tax issues, and you’ve earned that trust through transparency, customer service, and demonstrating your expertise. When preparing a client’s tax return , you must exercise due diligence and good faith, all while staying up-to-date on all IRS policies and guidelines. If you do not follow the IRS rules for preparing returns, you could be liable for penalties and fines.

Let's personalize your content