What’s new in sales tax?

TaxConnex

DECEMBER 3, 2024

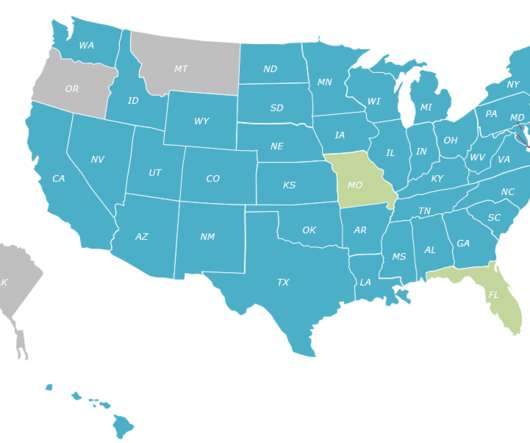

There’s always something changing in the world of tax, especially sales tax. The five-letter acronym stands for the states without a statewide sales tax – New Hampshire, Oregon, Montana, Alaska and Delaware – and two of those states might be leaving the group sooner than later. billion-plus from a 4% sales tax in FY25.

Let's personalize your content