Help Safeguard your Personal Information by Filing your 2021 Tax Return Early

RogerRossmeisl

JANUARY 19, 2022

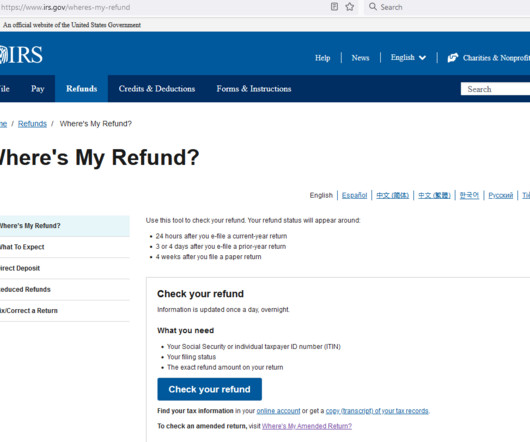

The IRS announced it is opening the 2021 individual income tax return filing season on January 24. Business returns are already being accepted.) You can potentially protect yourself from tax identity theft — and there may be other benefits, too.

Let's personalize your content