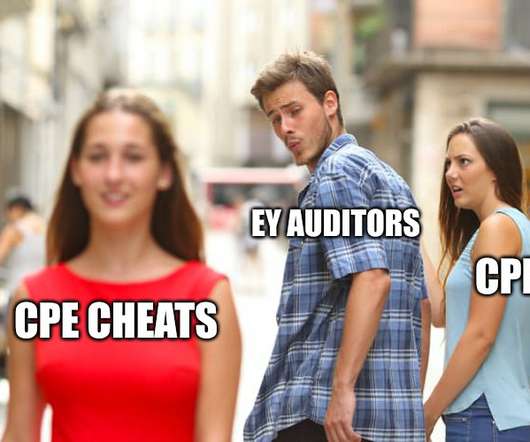

Big 4 Firms Fight Against Metrics That Would Reveal the Workloads Behind the Curtain

Going Concern

JANUARY 9, 2025

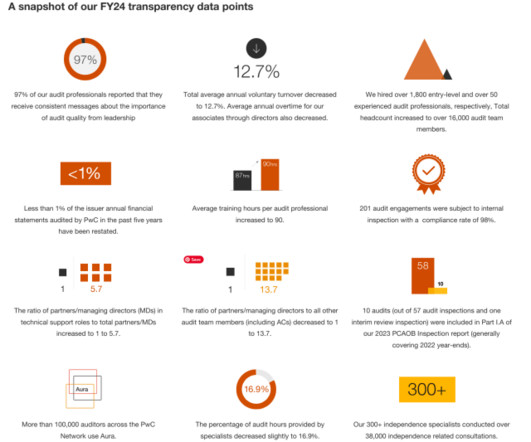

Training Hours for Audit Personnel. Experience of Audit Personnel. Average years of career experience of senior professionals in key industries audited by the firm at the firm level and the audited companys primary industry at the engagement level. Retention of Audit Personnel (firm-level only). across the firm.

Let's personalize your content