Small Business Tax Deductions: Pay Less in Taxes with Business Deductions in 2020

LyfeAccounting

OCTOBER 21, 2020

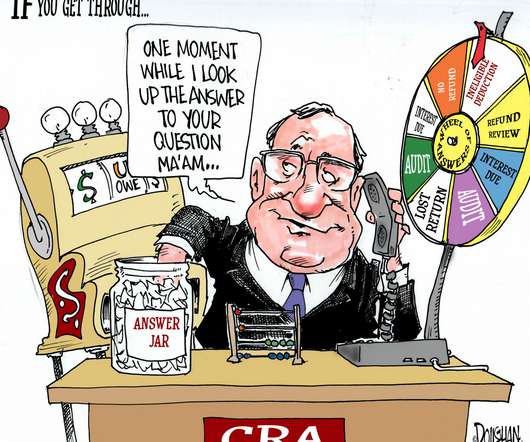

So I’d say, learn how to use small business tax deductions to lower your liability. Because you definitely don’t want to spend more in taxes for another year. In these times, whether your business is on the ropes or booming, you want to take advantage of deductions. Tax Deductible Categories. an accountant.

Let's personalize your content