Meta, Google face digital tax in New Zealand beginning in 2025

Accounting Today

AUGUST 29, 2023

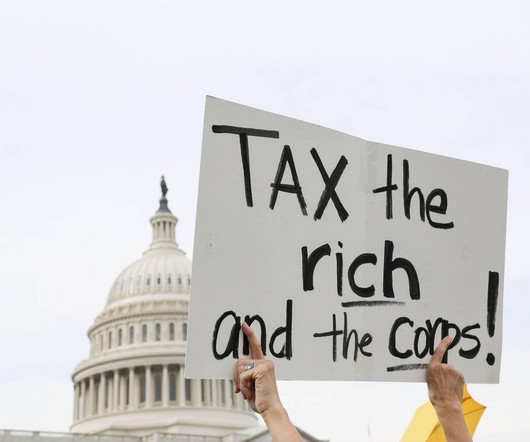

New Zealand will introduce legislation this week that enables a digital services tax on large multinational companies, though the levy won't be imposed until 2025.

Let's personalize your content