Defending IRS Cash-Based Audits – Guilty Until Proven Innocent: Computing Income

Withum

MAY 14, 2024

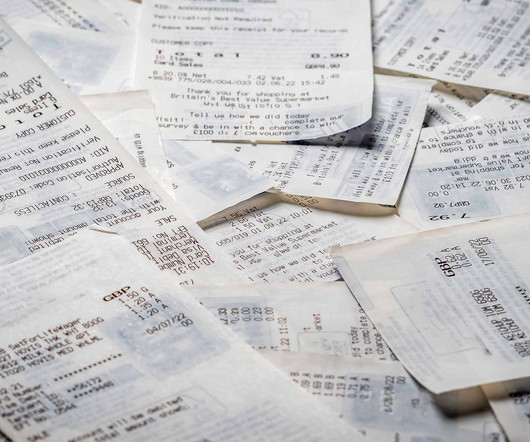

As discussed in our previous article, The Case for Using a Forensic Accountant , confronting the prospects of a cash-based audit is fraught with potential traps and exposure to civil and criminal penalties, including incarceration. This makes the forensic accountant part of the defense team. Cash has a destination.

Let's personalize your content