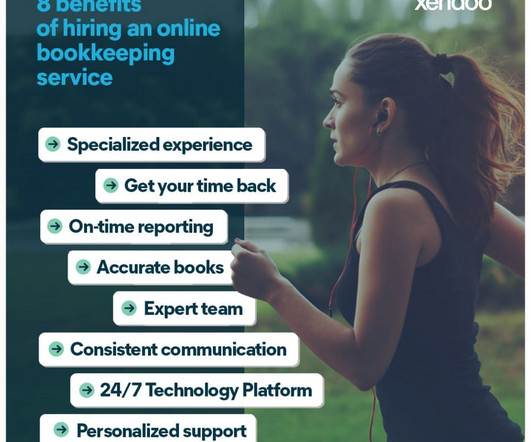

8 Benefits of Online Bookkeeping

xendoo

AUGUST 2, 2023

When you first started your company, it might have made sense to try to handle your own bookkeeping and accounting needs. Why not rely on an online accounting service to take these tasks off your plate so you can focus on your business? This is happening for good reasons, as online bookkeeping offers a host of benefits.

Let's personalize your content