What Is Deferred Revenue: Accounting Principles and Tax Treatment

inDinero Accounting

JANUARY 22, 2024

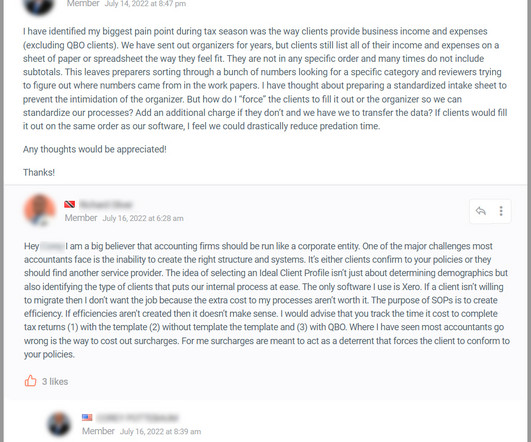

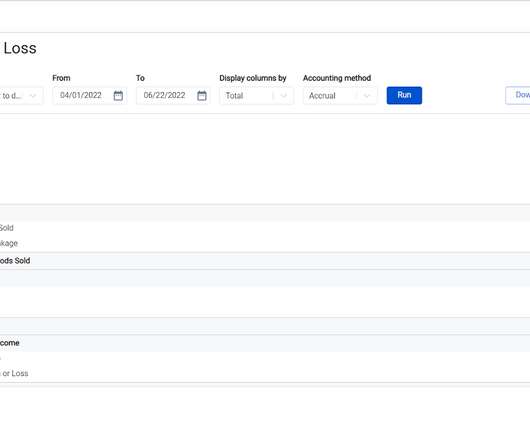

Terms like “deferred revenue” can confuse non-accountants, but the concept is easy enough. Deferred revenue refers to when customers pay upfront for products or services they will receive later while your accountant recognizes that income over time rather than all at once. Why Use Deferred Revenue Reporting Over Cash Accounting?

Let's personalize your content