Business Expenses and Tax Deductions: Indinero’s Ultimate Guide

inDinero Tax Tips

JUNE 24, 2023

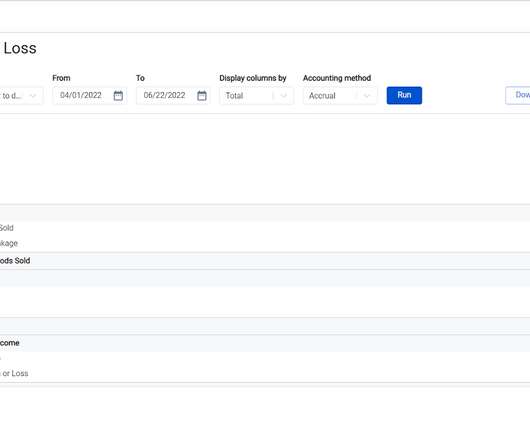

Small Business Tax Deductions Home Office Deductions Cash vs Accrual Accounting Nondeductible Expenses Form 941 Commingling Funds What Counts as a Business Expense for Tax Purposes? Cash accounting means registering transactions only when money lands in or leaves your account. Each method has advantages and disadvantages.

Let's personalize your content