What to know about Form 4562: Depreciation and Amortization

ThomsonReuters

DECEMBER 1, 2023

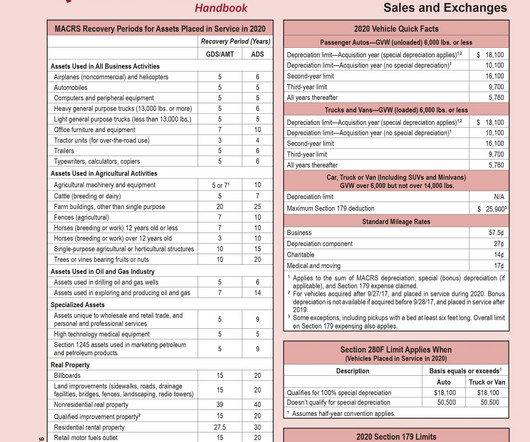

Jump to: What is Form 4562? What is listed property for depreciation? What does a depreciation schedule look like? What is Form 4562? Form 4562 instructions Is Form 4562 required every year? Section 179 and expensing property Running a company is expensive. Let’s take a closer look at the form and its uses.

Let's personalize your content