The Importance of an Accurate Balance Sheet

Basis 365

MARCH 23, 2023

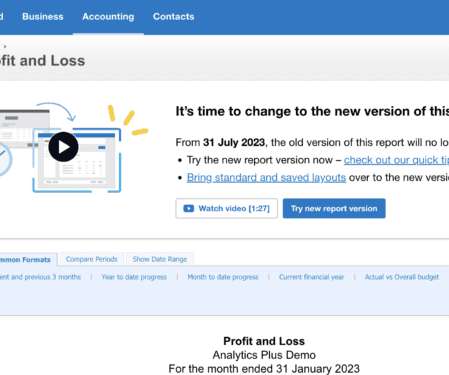

As a business owner, it's crucial to have an accurate and up-to-date balance sheet. A balance sheet is a financial statement that shows your business's assets, liabilities, and equity at a specific time. What is a Balance Sheet? If your balance sheet isn’t correct, your income statement is incorrect.

Let's personalize your content