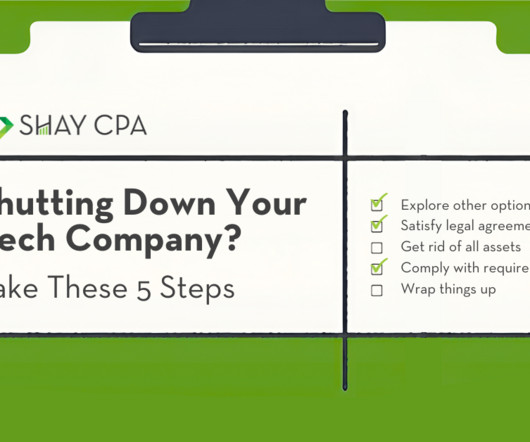

How to Dissolve a Company in Bad Standing Before Year-End

CPA Practice

OCTOBER 28, 2024

If applicable, final payroll tax returns must also be filed and payroll accounts closed, as well as any sales tax. Notify the IRS Dissolution also involves closing a company’s IRS business account. Nellie Akalp is a passionate entrepreneur, recognized business expert and mother of four.

Let's personalize your content