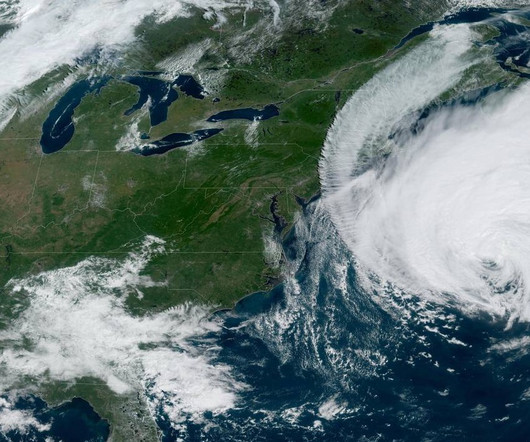

IRS Gives Tax Relief to Those Affected by Hurricane Lee in Massachusetts and Maine

CPA Practice

SEPTEMBER 25, 2023

The IRS on Monday announced that all individuals and business owners in Maine and Massachusetts now have until Feb. 15, 2024, to file their tax returns and make tax payments because of Hurricane Lee’s impact. Quarterly estimated income tax payments normally due on Sept. So, this is more time to file, not to pay.

Let's personalize your content