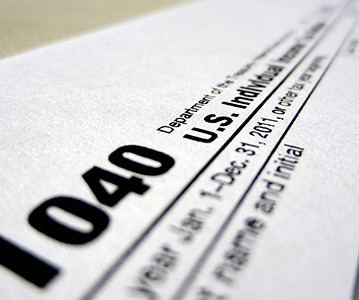

Sales Taxes in South Dakota to Decrease

CPA Practice

MAY 17, 2023

South Dakota’s state sales and use tax rate will drop from 4.5% The sales tax rate change is due to the enactment of House Bill 1137. As introduced, the measure sought to reduce the state sales and use tax rate to 4%. As introduced, the measure sought to reduce the state sales and use tax rate to 4%.

Let's personalize your content