Navigating IRS Bank Levies, Back Taxes, and Unfiled Tax Returns

MyIRSRelief

FEBRUARY 23, 2024

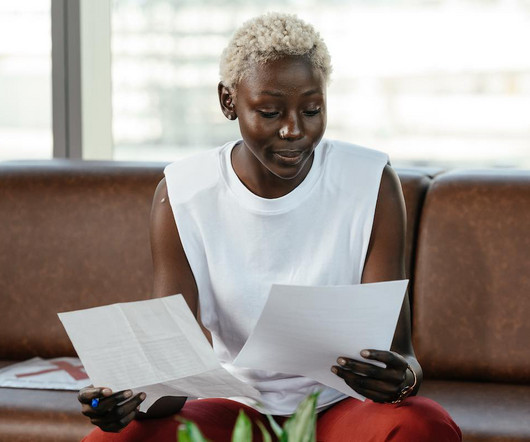

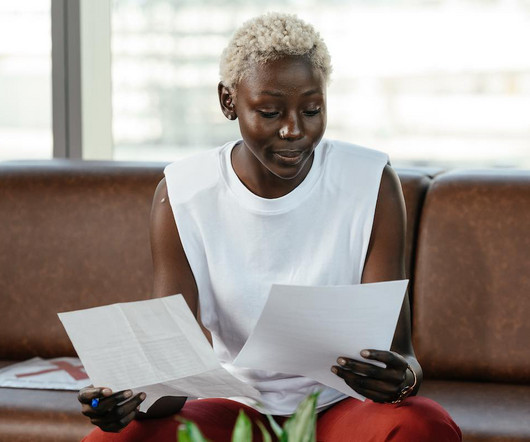

The Consequences of Unpaid Back Taxes and Unfiled Returns: Unpaid back taxes and unfiled returns can lead to a cascade of adverse consequences. Firstly, accumulating interest and penalties on unpaid taxes can significantly inflate the original debt, exacerbating financial strain.

Let's personalize your content