Why CPAs must master the soft skills

Accounting Today

AUGUST 13, 2024

When a CPA transitions from individual contributor to leader of many people, his or her technical skills alone will not be enough to drive results.

Accounting Today

AUGUST 13, 2024

When a CPA transitions from individual contributor to leader of many people, his or her technical skills alone will not be enough to drive results.

Patriot Software

AUGUST 13, 2024

Is creating, updating, and keeping a compliant company handbook stressful? Drafting a federal- and state-compliant handbook is daunting for many business owners and HR professionals. It can take weeks of research, writing, formatting, and editing. But it doesn’t have to. An employee handbook builder can streamline the process.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

BurklandAssociates

AUGUST 13, 2024

Demonstrate a clear grasp of these metrics, and you’re well on your way to building investor confidence and securing capital to fuel your SaaS startup’s growth. The post The SaaS Founder’s Guide to Seed Stage Fundraising Metrics appeared first on Burkland.

Accounting Today

AUGUST 13, 2024

A new template for a 'Written Information Security Plan' is available for practitioners to meet their mandate.

Speaker: Victor C. Barnes, CPA, MBA

CPA Practice

AUGUST 13, 2024

H ealthcare benefits play an important role when it comes to an employer’s ability to retain and hire employees. More than two-thirds of employees surveyed a new Intuit QuickBooks survey conducted in collaboration with Allstate Health Solutions , said healthcare benefits are second only to salary when considering a job offer, and 78% said they would find a new job if their benefits package was inadequate.

Accounting Today

AUGUST 13, 2024

The Treasury Inspector General for Tax Administration said the IRS lacks concrete plans for retiring and replacing legacy IT systems.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Accounting Insight

AUGUST 13, 2024

Company secretarial software and formations specialist Inform Direct is looking forward to exhibiting again at this year’s Accountex Summit Manchester, following previous successful visits. Over the last 12 months, the company has introduced a number of significant enhancements to its cosec product, with new features and functionality to meet emerging requirements for accountants.

Accounting Today

AUGUST 13, 2024

The Top 100 Firm is retiring the role of managing principal and adopting the new leadership structure on Jan. 1, 2025.

Going Concern

AUGUST 13, 2024

According to the latest information on the AICPA’s “ Find out when you’ll get your CPA Exam score ” page, score release dates for Q1 2025 were due to be published “in the beginning of August.” There’s no doubt that timeline was purposely vague to leave room for the ongoing tweaking of CPA Evolution implementation and other circumstances both foreseen and unforeseen.

Accounting Today

AUGUST 13, 2024

NASBA's Accounting Education Research Grants aim to advance academic research on the educational issues impacting CPAs and the accounting profession.

Speaker: Kim Beynon, CPA, CGMA, PMP

Cherry Bekaert

AUGUST 13, 2024

Episode four of the Grants Management Podcast series focuses on indirect costs related to grant projects and the importance of capturing those costs to assist your organization with grant-related personnel and overhead expenses. This podcast episode is hosted by Kimberly Konczack, an Advisory Manager at Cherry Bekaert, and Kat Kizior, Manager, with special guest Nikky Lettini, Managing Director, Advisory Services.

Accounting Today

AUGUST 13, 2024

The affected by severe storms and flooding in June now have longer to file and pay.

Cherry Bekaert

AUGUST 13, 2024

In this episode of Cherry Bekaert’s Government Contracting podcast, we discuss ways to optimize the benefits of outsourcing your accounting operations. Host Craig Hunter, a Director in the Government Contracting Industry practice, is joined by Mike Cippel, Managing Director, and Directors Irwin Kaplin and Jonathan Reid. Tune in to learn more about: Deciding if outsourced accounting is your best option Uncovering the benefits of using an outsourcing firm Optimizing the working relationship with a

Accounting Today

AUGUST 13, 2024

Former investment banker Martin Shields had already paid €3 million for his part in a dividend-tax refund scheme, and will now pay an extra €11 million.

Anders CPA

AUGUST 13, 2024

St. Louis is fast emerging as a powerhouse in the biotech and health care startup industries, thanks to a confluence of support organizations, investment opportunities and community initiatives that foster innovation and growth. Major players involved in this transformation include BioSTL , Cortex and the Danforth Plant Science Center , an anchor institution of 39 North.

Accounting Today

AUGUST 13, 2024

The investment firm late Monday said it couldn't file its quarterly report with regulators on time, due to problems in valuing its loans and investments

Going Concern

AUGUST 13, 2024

Don’t know if this is particularly newsworthy but we happened across this PwC posting for audit interns and thought hey, it might be neat to look back on this ten years from now and see it’s barely increased at all just how much it’s increased since the good old mid-’20s. Assuming this website still exists in 2035, that is. So in 2025, PwC is paying summer interns $30.75 – $40.75.

CPA Practice

AUGUST 13, 2024

There are now 16 public accounting firms in the U.S. that surpassed the billion-dollar mark in revenue during their most recent fiscal year, according to the newly released top 500 firms ranking for 2024 from INSIDE Public Accounting. New York City-based CohnReznick joined the “billion-dollar club” with revenue of $1.05 billion. There were 15 firms that surpassed $1 billion of revenue last year.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

Accounting Insight

AUGUST 13, 2024

Rising customer expectations and increased competition are placing pressure on accountancy firms to deliver better customer experiences and greater value to stand out from the crowd. Those accountancy firms that can provide global services at scale are the ones that will be able to retain and build their client portfolio. To alleviate these challenges, accountancy firms could boost their bottom line and optimise customer experiences in collaboration with a payments company.

Accounting Today

AUGUST 13, 2024

Crypto moves forward; what to know about gambling; new blog in town; and other highlights from our favorite tax bloggers.

Cherry Bekaert

AUGUST 13, 2024

With the release of the revised Form 6765, there are significant changes of which businesses claiming the R&D Tax Credit need to be aware of. The new Form 6765 requires more detailed information regarding the R&D projects being performed, which can be complex and time-consuming to file accurately. Additional changes were also recently made for companies filing amended returns.

Insightful Accountant

AUGUST 13, 2024

This is a prologue of Murph's second part of his in-depth series on Acumatica. this summary reports on the retail and eCommerce capabilities of Acumatica ERP including numerous eCommerce integrations and integrated POS offerings.

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

CPA Practice

AUGUST 13, 2024

By Kylie Garcia The Santa Fe New Mexican (TNS) Aug. 5—New Mexico is now the fourth state that can use the IRS’s new system for filing federal taxes, which officials believe will make the 2025 tax season easier and save people time and money. After conducting successful pilots in 12 states last year, the U.S. Treasury Department and the IRS announced the Direct File system as a permanent option in May and invited all 50 states to jump on board.

Insightful Accountant

AUGUST 13, 2024

This month's edition of QB Talks is a ProAdvisor Roundtable featuring some of our 2024 ProAdvisor Top Award Recipients. Murph and Gary will be hosting this informative discussion with leading ProAdvisors.

LSLCPAs

AUGUST 13, 2024

LSL Webinar ‘Back to Basics | Lighten Your Year-End Load: Tackle Accounts Payable, Accrued Liabilities, and Long-Term Debt Reconciliations with Ease’ presented by LSL Manager Jayme Lambert, CPA, and Supervisor Monica Fernandez outlined how local government finance departments can start the new fiscal year with ease by staying ahead of the game by addressing challenges proactively.

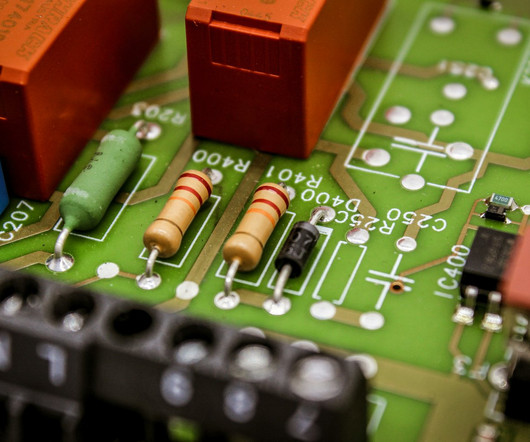

CPA Practice

AUGUST 13, 2024

Top 15 accounting firm Crowe has added Sylint Group, a Sarasota, FL-based cybersecurity advisory firm that has extensive experience in dealing with cyber incidents and precedent-setting court cases. Crowe said the deal will enhance and expand its offerings across the firm’s forensics and legal consulting and cybersecurity businesses and boost its incident response services.

Advertiser: Paycor

Before you can achieve success, you have to define it. Objectives and Key Results (OKRs) give you the framework to do just that. Paycor’s free guide includes a step-by-step process leaders can use to work toward – and achieve – their loftiest business goals.

LSLCPAs

AUGUST 13, 2024

LSL Webinar ‘Back to Basics | Lighten Your Year-End Load: Tackle Accounts Payable, Accrued Liabilities, and Long-Term Debt Reconciliations with Ease’ presented by LSL Manager Jayme Lambert, CPA, and Supervisor Monica Fernandez outlined how local government finance departments can start the new fiscal year with ease by staying ahead of the game by addressing challenges proactively.

Ronika Khanna CPA,CA

AUGUST 13, 2024

This is a transcript from my YouTube Video on 5 Reasons Why Your Business Needs Accounting System Hello everyone! Today, I want to dive into a crucial topic for small business owners: accounting systems. Whether you’re just starting out or have been in business for a while, understanding the importance of an accounting system is essential for your success.

CPA Practice

AUGUST 13, 2024

Financial automation platform LiveFlow has integrated with Xero, enabling businesses and accounting firms to streamline financial planning and analysis (FP&A), consolidate financial data, and easily visualize their financials. “We are thrilled to launch our integration with Xero,” Anita Koimur, COO and co-founder of LiveFlow, said in a statement.

Summit CPA

AUGUST 13, 2024

Jody and Jamie take a deep dive into an episode of Jason Swenk's Smart Agency podcast.

Speaker: Frank Taliano

Documents are the backbone of enterprise operations, but they are also a common source of inefficiency. From buried insights to manual handoffs, document-based workflows can quietly stall decision-making and drain resources. For large, complex organizations, legacy systems and siloed processes create friction that AI is uniquely positioned to resolve.

Let's personalize your content